r&d tax credit calculation example uk

SME Scheme calculation for a company that was profitable and spent 100000 on qualifying RD activities in a given year. Use e-Signature Secure Your Files.

Autumn Budget 2017 And R D Tax Credits Forrestbrown

The next step takes the current year expenditures of 95000 and subtracts the 40000 three-year.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Assembling successful RD credit claims began by shifting the focus from their merit social.

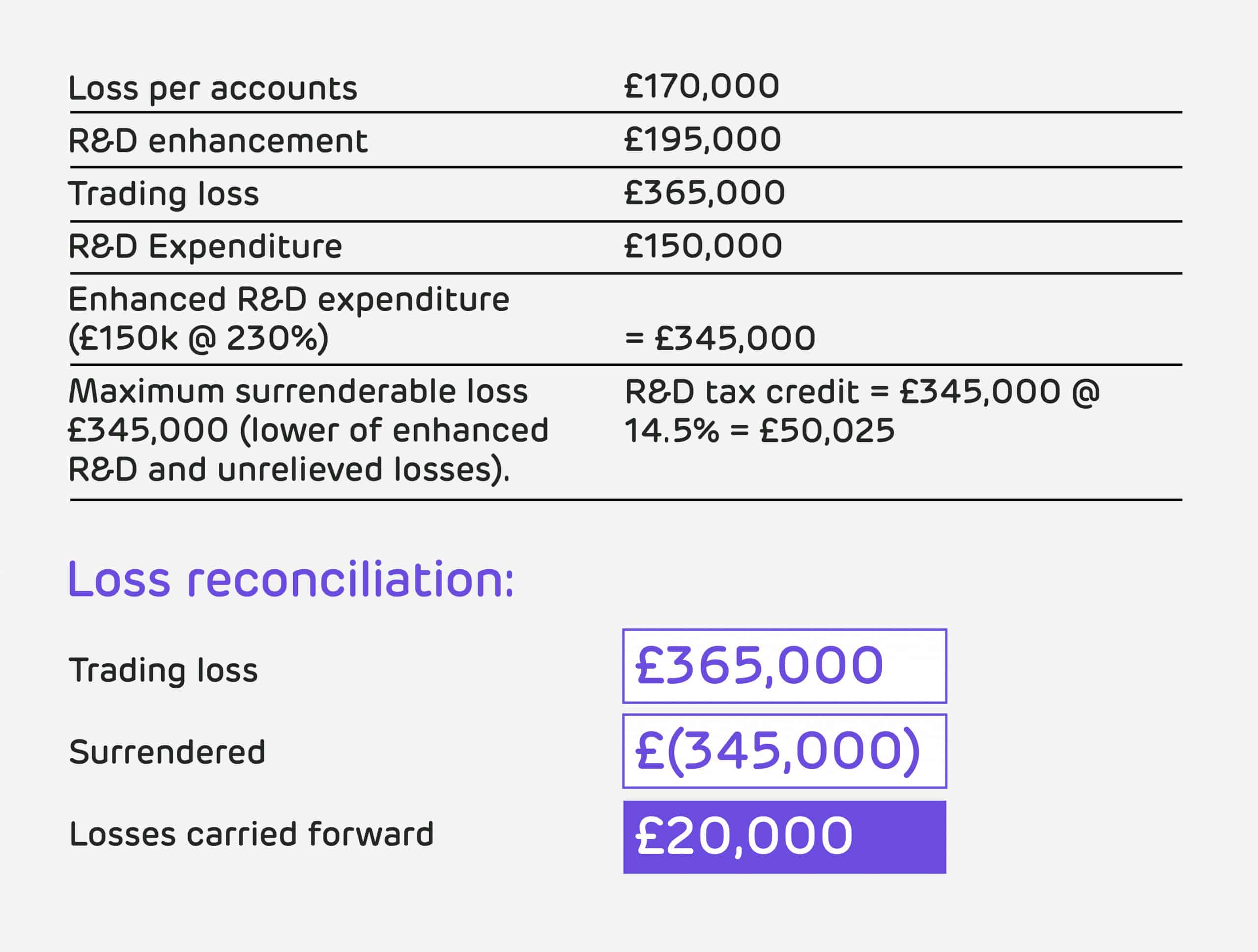

Deduct the RD enhanced expenditure within the tax computation. The notional additional 130 RD tax deduction is deducted within the company tax computation. You take 50 or half of this amount which is 40000.

Beam can only receive tax credits for the engineering and tech progress that powers it. Ad Advise Your Clients With An RD Tax Credit Partner You Trust. The RD Tax Relief scheme allows a further deduction to be made calculated as 130 of the qualifying expenditure identified.

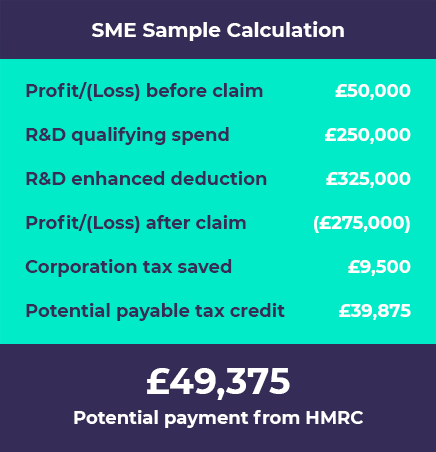

100k QE in this example. Most companies in the UK that claim RD tax relief fit into the SME category. How to Calculate RD Tax Credit for SMEs.

Just follow the simple steps below. Average calculated RD claim is 56000. Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

Calculate how much RD tax relief your business could claim back. Below are the various examples of how a claim value is calculated. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC.

The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has an effect on. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. It was increased to.

100000 x 230 230000. Ad Dont miss out - Get rewarded for your innovations today with RD Tax Credits. Call 01332 819 740.

The next step is easy. The rate at which businesses calculate their RD tax credit depends on. Upload Modify or Create Forms.

The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. Free RD Tax Calculator. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief.

If you dont have all. Home RD Tax Credits Calculator. RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations.

First however the fix-based percentage must be obtained by. To find out more RD Tax Credit Project Examples for your industry or to learn more about what the RD Tax Credits. RD Tax Credit Calculation Examples.

Select either an SME or Large. Ad Dont miss out - Get rewarded for your innovations today with RD Tax Credits. Try it for Free Now.

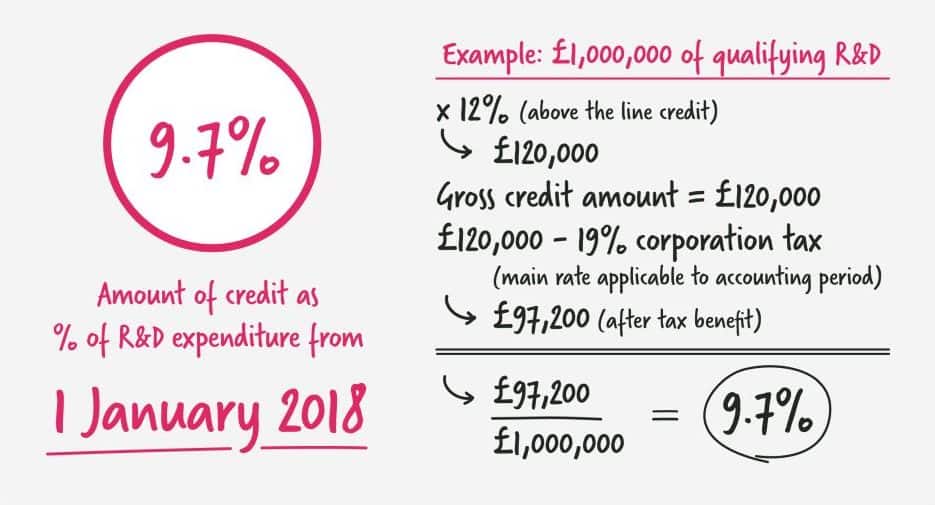

RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Return On Investment Roi Formula And Excel Calculator

R D Tax Credits The Essential Guide 2020

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Research Development Tax Credits Guide Ebs European Business Solutions

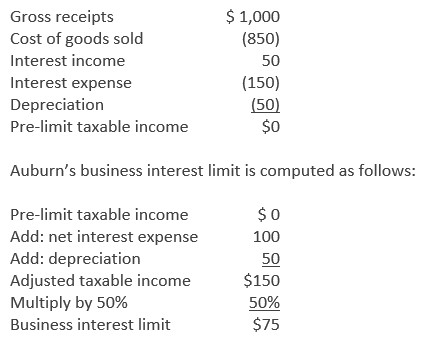

Final Business Interest Limitation Rules Present Opportunities 2020 Articles Resources Cla Cliftonlarsonallen

R D Tax Credit Calculation Examples Mpa

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Naked Credits And The Interest Expense Limitation

How To Be Proactive With R D Tax Credits Accountants Guide

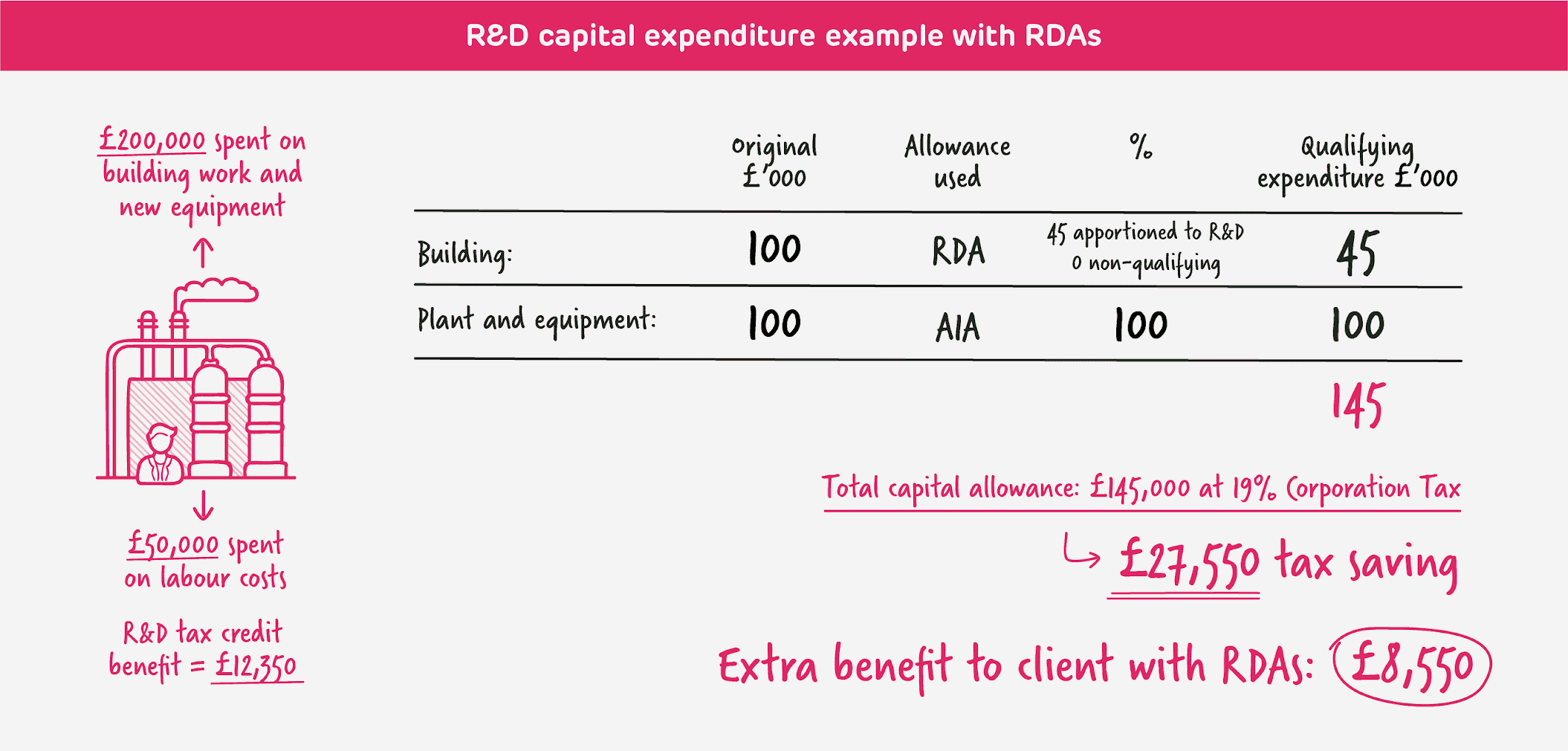

R D Capital Allowances R D Capital Expenditure Explained

R D Tax Credits Calculation Examples G2 Innovation

Rdec Scheme R D Expenditure Credit Explained

Theatre Tax Relief Example Calculation Examples

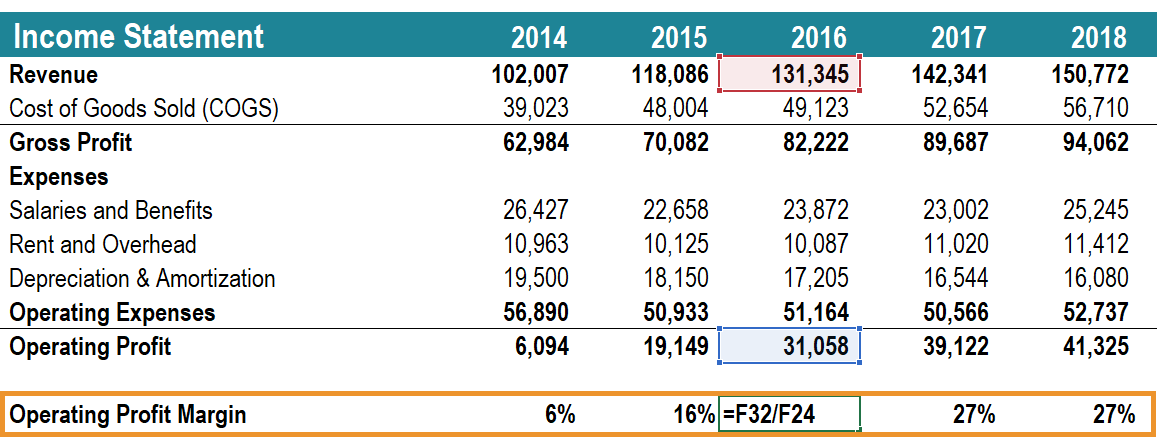

Operating Profit Margin Learn To Calculate Operating Profit Margin

Rdec 7 Steps R D Tax Solutions

R D Tax Credit Calculation Examples Mpa